Amanda Volz

From standing desks, to couches, beanbags and ergonomic seating, Amanda Volz’s classroom setup is designed for collaboration. The new classroom blueprint is becoming a trend across the country. Personal finance educator Amanda Volz has taken full advantage of the $20,000 grant to redesign classrooms at St. Clair High School in Michigan. Utilizing the work of professional designers and students alike, the "classroom of the future" is a completely restructured learning space.

"It’s more brain-friendly," explains Amanda. "We tried to empathize with students. They sit in these desks all day long. Kids should be moving around."

Amanda stands with faculty and her student, winner of the 2015 H&R Block Budget Challenge.

Amanda has altered her teaching methods since this classroom renovation. Her curriculum is a hybrid of group and individual work, comprised of both online and in-class instruction. While she follows the same unit plan each year, it’s a living, breathing document. She has no textbook. "I try to be current," she says. "For example, we discussed the Equifax breach. I have to talk about that."

Amanda Volz has been teaching for 16 years – and for 14 of them, she has taught personal finance. After teaching marketing and intro to business courses, she decided she loved teaching personal finance for its practicality. Amanda was a leading advocate to extend the availability of the course, as it used to be only offered as a semester-long credit. Students can also take the course as a 4th year math requirement, increasing the popularity. "Its grown tremendously. For the last two years, I’ve taught personal finance all day long and all year long," Amanda says. She has five classes a day, totaling to about 150 students.

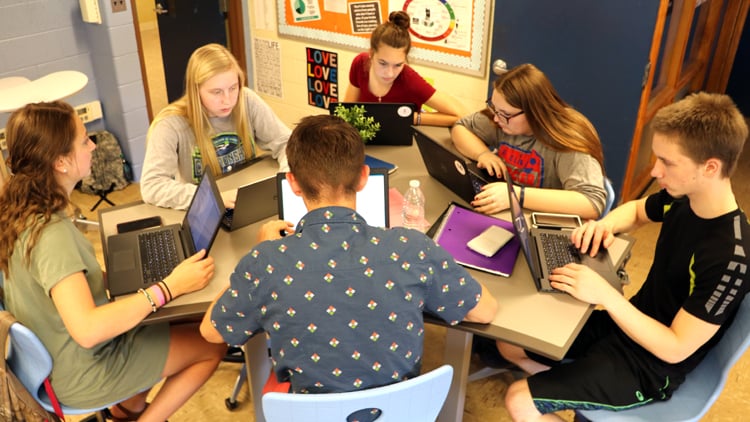

Students work in the "classroom of the future," designed for collaboration and teamwork.

Her classes are mainly comprised of high school seniors, which Amanda says is the prime age to introduce personal finance education. Her students are starting to think about student loans, buying a car or getting a part-time job. "Their mindset is already in an early adult stage," she points out. From budgeting, to credit, to mortgages to auto loans, a lot of the real world permeates the classroom. "Bring in your 1040 forms. Bring in your FAFSA," she says to students.

Amanda’s students frequently work in groups to master financial literacy concepts.

The bulk of her curriculum is comprised of simulations. The Stock Market Game is a popular one, along with the H&R Block Budget Challenge. Amanda has had nine Budget Challenge winners in the past three years, yielding over $280,000 in scholarships. Four years ago, the first time H&R Block sponsored the challenge, one of Amanda’s students won a $120,000 scholarship. His initial plan was to attend a local community college, but the scholarship changed his education plan and he now attends a four-year university.

"That kind of success has bred success," she explains. "I am lucky enough to teach an all-inclusive personal finance class. My curriculum directly relates to the challenge; I can continuously reference the simulation because they’re managing budgets and credit cards every day."

From high-top tables to ergonomic seating, Amanda’s classroom is conductive to all learning styles, form independent to group work.

Amanda is a proponent of all kinds of real world applications. While the simulations allow the material to "stick" to the students more than a textbook, she also has financial planners and insurance agents from the community come in and answer students’ questions. "I have students that contact me all the time asking for budget forms, or help on student loans and buying a car.

Can you remind me about this? They’ll say." With Amanda, communication is always open with her students – long after graduation. Her students stay in touch with her via email, asking her for personal finance reminders as they traverse the adult world. The one question students always ask her is why her class isn’t required.

Amanda’s classroom feels more like a startup than a classroom, complete with soft easting and various work stations.

Amanda believes that the success of her teaching lies in the fact that personal finance is a standalone course at St. Clair High School. Other districts are not as fortunate. In the state of Michigan, students need one semester of economics to graduate, but in her year-long course, Amanda can take her students on a more detailed journey into personal finance basics. "It’s not embedded in social studies or math, so I can dive deeply into topics." After teaching thousands of students in her career, her defined goal is to equip them with a big-picture view of the finance world. She wants them to be able to evaluate different offers and execute informed decision-making.

Practical Money Skills would like to commend Amanda Volz on her ongoing efforts and commitment to financial literacy at St. Clair High School.

Students in Amanda’s class collaborate together and work on laptops.

Share