Andrew Borgialli

Andrew Borgialli, a personal finance teacher in Gillette, Wyoming, has found a way to motivate his students with a classroom incentive program. He piloted the BoltBuck$ program, a personal banking system rooted in the classroom, in his Money 101 course.

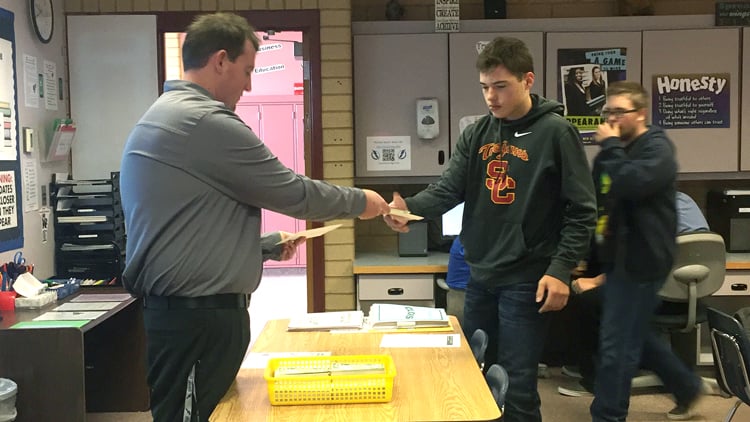

Andrew's students get "paid" virtual BoltBuck$ as a classroom incentive.

Through the BoltBuck$ program, students get paid every day to come to class and participate; the money serves as a classroom incentive. They can then use that money to buy back the chance to complete missed assignments or earn extra points on tests. Not only does this system reinforce banking and personal finance concepts, it also promotes a dynamic and engaging classroom. "It doubles as a recruitment tool, too," Andrew says. His Money 101 course is the most popular business class offered at Thunder Basin High School.

Andrew's own high school business teacher inpired his passion for teaching personal finance; he was moved by the practicality of business as a field and by the potential benefits of sharing its concepts with young people. As personal finance skills are applicable to every stage of life, his curriculum builds on kids' personal life-knowledge and touches on milestones like opening up a checking account or buying a car. Andrew says, "My students will ask, ‘What are we doing today?' And I'll say, ‘We're doing life.'"

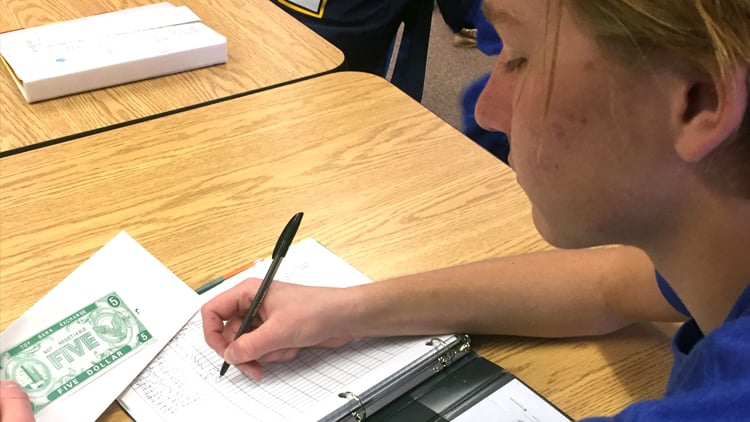

A Money101 student logs five BoltBuck$ in their bank account.

After teaching high school and junior high students at several schools in Wyoming, Borgialli was asked to teach a personal finance course at Campbell County High School and now Thunder Basin. Given that his teaching background was in computer-based and career development classes, he was concerned. "To be honest, I was scared," he says. "It was different than anything I have ever taught before. But now I can't imagine teaching anything else."

The course he teaches was formerly called Money Management Strategies. After giving it an overhaul and reorganizing the units, he renamed it Money 101 to entice prospective students. He was able to revamp the primary learning units to match the national standards, further innovating his curriculum. "I don't use any one set of curricula. You see what works with the kids," he explains. "Every semester is different based on the group of kids that you have. I've never taught anything the same way twice."

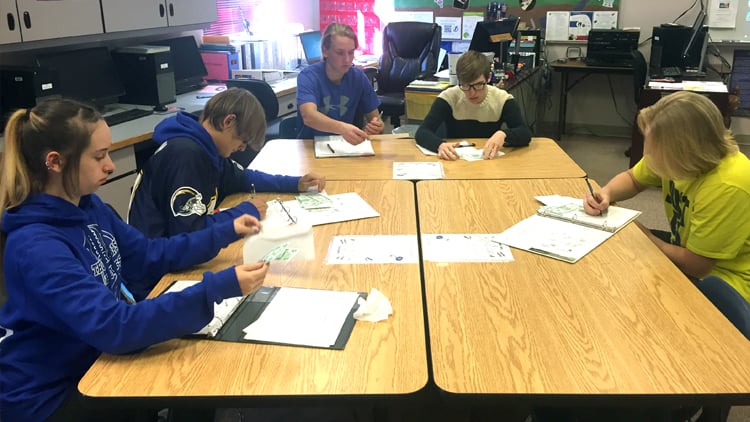

Andrew's students periodically log their BoltBuck$ income in personal journals.

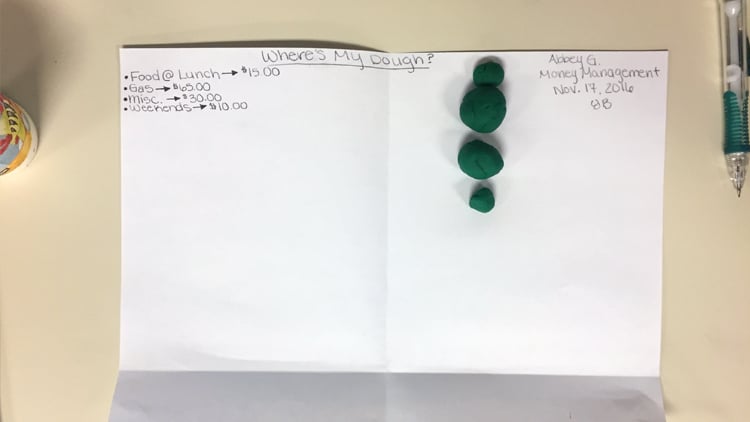

Andrew's methods are hands-on and experiential. Utilizing active learning tools, real-life situations and problem solving, he brings the world to his classroom. During his unit on taxes, he prints 1040EZ forms from the IRS website and has students fill them out. In his budgeting unit, students outline budgets using tools like Excel. He facilitates another budgeting activity called "Where's My Dough?" wherein students are instructed to roll out sections of Play-Doh in proportion to their monthly expenses. He makes his own financial life an open book for this purpose, sharing information from his tax returns, pay stubs, and net worth statements with students.

Above all, Andrew believes money management is largely introspective. He encourages the use of a "financial journal" throughout the semester, documenting how one might behave in a situation before and after having learned a particular concept or financial management skill. He poses loaded questions: "If you had a million dollars, how would you manage it?"

"Where's My Dough" is a hands-on activity where students are instructed to roll out Play-Doh in proportion to their monthly expenses within a budget.

Another way he engages students through playing online games like Financial Football in class. "The kids like the Practical Money Skills calculators," he adds, notably the Lunch Tracker app and Plan'it Prom "I pull them up on the big board in the front of the classroom. They're a powerful visual."

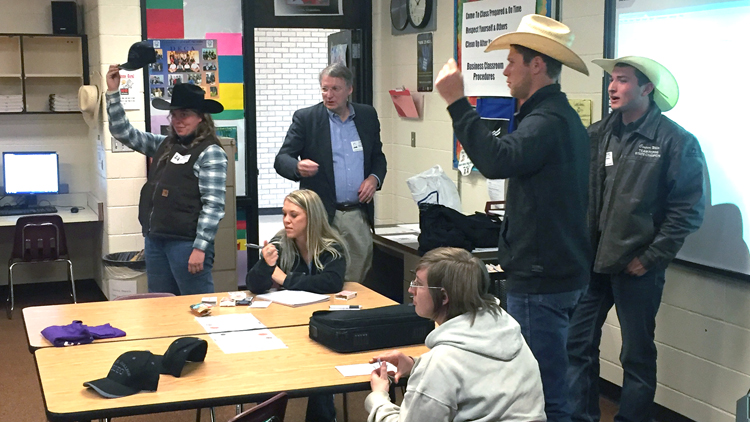

While mobile apps and financial calculators are popular with his students, classroom visits by representatives from the community are also a hit. Connecting with local banks and bringing in speakers has been a part of Andrew's approach since he began teaching. From expertise on banking regulations to various savings accounts and how to purchase a car, he presents a span of industry knowledge to students. He even brought in a human resources coordinator to talk about employee benefits such as retirement planning, health insurance and paid vacation.

Andrew has fostered a partnership between Thunder Basin High School and local colleges to bring in business majors to work with his Money101 students.

A rock concert on campus was another successful teaching tool. Through Funding the Future's Financial Literacy Program, Andrew arranged to bring the band Gooding to perform an information-packed show emphasizing good saving habits, wise use of credit and debt, and the reality of working toward dreams versus the myth of overnight success. Hundreds of students showed up, filling their school auditorium to capacity. After bringing Gooding to Gillette twice with an outpouring of enthusiasm from kids and staff, Andrew is confident initiatives like these will help spread awareness about what it means to be financially fit. Thunder Basin's activities director, a teacher for 35 years, says the show was the most successful campus event he's ever seen.

In his Money101 class, Andrew facilitates a mock auction as an active learning tool.

Outside the classroom, Andrew is president of the Wyoming Business Education Association. "I'm passionate about sharing knowledge and experience with other teachers," he says. While the state of Wyoming currently does not require high school students to take a personal finance course, Andrew's Money 101 class reaches capacity, serving between 100 and 200 kids per year. He administers pre- and post-tests to measure the impact of his lesson plans and portrayal of concepts, with an average score of around 50 percent beforehand and between 70 and 80 percent after.

His students made collages depicting various aspects of a budget, from wants, to needs, to personal finance goals.

"My philosophy is to show kids two or three different ways of doing something," he says. "Two or three ways to teach them critical thinking and problem-solving skills." That helps equip students to make their own informed financial decisions far beyond the classroom walls.

Practical Money Skills would like to commend Andrew Borgialli on his ongoing commitment to financial literacy and his efforts at Thunder Basin High School.

Students receive Money Management Certificates upon completing an online personal finance course in conjunction with Andrew's course, Money101.

Share