Erika Fix

Erika Fix has distinguished herself as a leader in the financial education space with her unique Personal Economics courses and a summer camp focused on financial literacy. She has been teaching for 15 years, currently at Gladstone High School in Gladstone, MI.

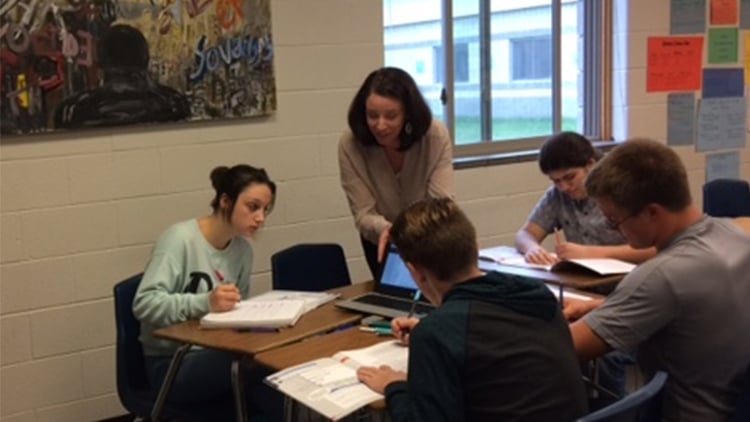

The Personal Economics courses are year-long and focus on professional development, utilizing project based curriculum. The main topics cover personal financial decision making, institutions, investing and protecting what you have. Erika uses real life simulations, such as how to pick the best loan for each student and the difference between families with or without debt. Other teaching methods include case studies, computer programs, math activities, group learning, posters and smart goals. To make topics more fun, students play games such as Jenga and Monopoly to teach vocabulary and housing costs, as well as compete in the SIFMA Foundation's Stock Market Game. Many of Erika's students get their first credit cards after taking her course and learn about credit terms and how they apply to their own life.

Erika incorporates three main ideas into each unit of her course. First, that you can't judge wealth by appearances. People with fancy cars and huge houses may actually be deep in debt and people who live frugally may have accumulated a great deal of wealth. "Even the seemingly small amount of money saved on not buying coffee every day can add up to big savings," explains Erika. Second, careers in finance are a great choice for young people. Third and maybe most importantly, she teaches that the principal saved is only one factor in accumulating wealth. The other factors, time and interest, are even more important. "I think it's the most important subject kids can learn in high school. Kids know how important it is, and they're excited to learn something that has impact on their lives," says Erika.

It's important to start teaching money topics to kids at a young age, and Erika advocates that 3rd or 4th grade is the sweet spot. To help educate this younger age group, she organized a team of teachers to lead a district-wide financial literacy initiative. In the first year they acquired enough funding to open an elementary summer camp focused on financial literacy where 23 students attended. This coming summer they anticipate opening a middle school camp in addition to the elementary program and hope to reach over 50 students. 100 percent of students said they wanted to participate in another camp.

Another key pillar to Erika's teaching efforts is to support and provide financial education to the broader community. "It's evident that very few students come into my Personal Economics course with previous knowledge about personal finance," explains Erika. One reason may be that some parents aren't comfortable teaching their children about finance, making students all the more excited to take home the knowledge that they learn in the classroom and apply it to their family life. She teaches her students skills they can take home, including college loans and grants, scholarships and how to apply for the FAFSA. To further provide financial education to the community, Gladstone High will offer personal economics courses for parents to learn about college savings accounts, banking accounts and credit.

The program has seen a lot of success under Erika's leadership. When she started teaching the Personal Economics class six years ago, they averaged 25 students per year. This year, they are at 60 students enrolled with a graduating class of about 150.

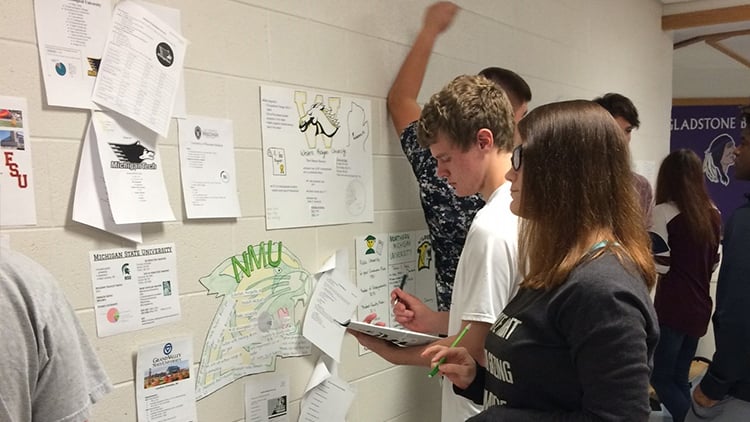

In 2015, Erika helped develop a relationship with a local credit union, which sponsors their Financial Fair, a budgeting simulation. Prior to the fair, the senior class researches entry level pay for their chosen career. They are assigned a credit score and a student loan debt amount and are asked to complete a monthly budget including housing, utilities, transportation and other necessities. Students were asked to complete a post fair survey and 92 percent of students responded that the experience met their expectations. 85 percent of students said they would change their saving and spending habits as a result of the experience.

The Financial Fair isn't the only activity that stands out. Last year was Gladstone's first year participating in the National Personal Finance Challenge by the Council for Economic Education, where Erika's team ranked 4th in Michigan during the state finals. Her students produced a product to advertise to other communities the importance of financial literacy.

Practical Money Skills would like to commend Erika Fix for her ongoing efforts and commitment to financial literacy at Gladstone High School.

Share