Innovative Educator

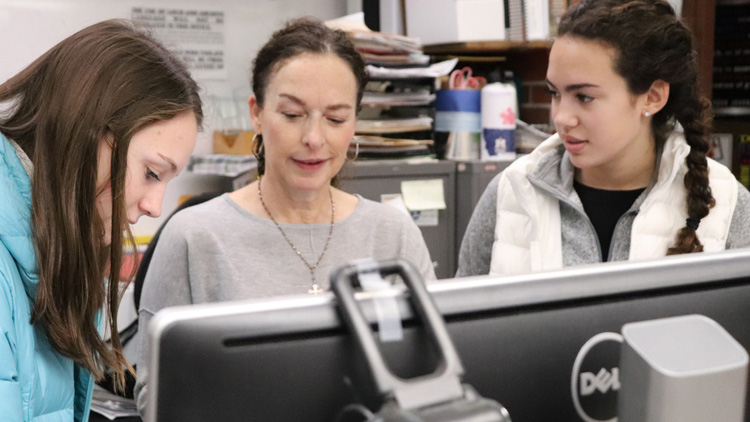

Educator Jill Page integrates personal finance topics into her courses and spearheaded a dedicated personal finance class to be offered at Glasgow High School in Montana.

With 17 years of teaching experience and inspiration from educator conferences such as Jump$tart Coalition for Personal Finance and Next Gen Personal Finance, Jill saw the need and value in providing a more robust personal finance course for students. In order to get the class approved, Jill submitted a proposal to her school administration, and was approved this past year. Having successfully completed her first semester-long Personal Finance 101 class, Jill is hoping to make it a year-long class in the future and continue to improve her course.

Teaching at a small school in rural Montana means that Jill is posed with the challenge of teaching students throughout grades 9-12. To appeal to the broad age range of high school students in her personal finance course, Jill designs her lessons around the needs of her students by utilizing various teaching styles. She balances textbook lessons with computer projects, games, hands on activities, group work and guest speakers. Due to the fact that different topics are important to different students, she emphasizes the value of group discussions and daily hands on activities.

"Teaching multiple age groups is exciting because they all seem to view personal finance differently based on what is important to them at that age. I love the excitement the younger students demonstrate and then the confidence the seniors have after having all of my classes and them experiencing the need for their savings account because they had an emergency and had the money," explains Jill.

At the beginning of her Personal Finance 101 class, Jill offers a career planning unit for students to research their career of choice and participate in activities related to their careers throughout the course. For example, her students will research salaries for their chosen careers and determine a hypothetical budget and learn to track their expenses and assets while playing games like dice, Monopoly and Life.

Jill also incorporates personal finance topics into her other courses, Computers and Jobs for Montana Graduates (JMG). JMG is a class and club that helps prepare students for life after high school, whether in securing a post-secondary education or quality job. In this course, Jill covers the basics of financial management and provides them with a false identity binder for them to set up a budget and career based on their interest and GPA.

In her freshman computer course, she offers Financial Fridays where students use a computerized financial literacy curriculum with videos and games. “I think it is extremely important to teach the basics of money management to our freshman at the high school level because the sooner they can develop good money habits the better off they will be as adults. If I can help them avoid lifelong mistakes financially or make them aware of them at an early age, I believe that is a huge win," explains Jill.

Two students have won $500 scholarships two years in a row through Next Gen Personal Finance’s Payback Challenge, where students played the game and submitted a short essay on what they learned.

Jill sees the positive impact of her teaching when students come to her with questions about their pay stubs and about opening a savings account or checking account. One student came in and showed Jill that she did her taxes on her own, saying that she was her motivation after taking her class. Many of her students even took her Personal Finance 101 course for a dual college credit.

Practical Money Skills would like to commend Jill Page on her ongoing efforts and commitment to financial literacy at Glasgow High School.

Share