Laurie Gardner

Laurie Gardner’s personal finance classroom is far from conventional. By redesigning the space from the top down, she has created an innovative learning experience in which her students thrive. From independent work, to group work, to guest speakers, Laurie has given a new face to financial education at Marine City High School in Michigan.

This is reflected in what Laurie calls her “21st century classroom.” While she is the first teacher at Marine City High School to pilot this learning model, she says it enhanced the productivity of her classroom. Complete with couches, beanbags, a high top table, and tables on wheels, the layout looks more like a startup office than a traditional high school classroom.

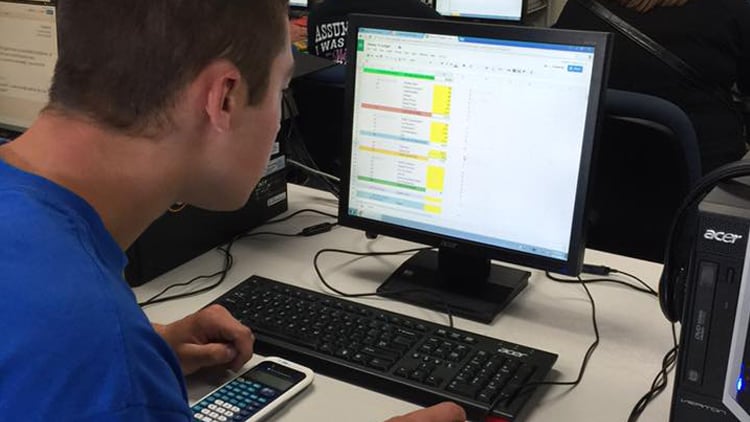

Students work on a budgeting spreadsheet in Financial Management.

“Students can sit where they are most comfortable,” Laurie says. The setup has encouraged collaborative group work, as it’s much easier to switch up activities throughout the hour. Her students also use tablets rather than desktop computers, enabling them to switch partners between tasks. “It's been great for creativity and critical thinking,” she says.

Laurie is not new to the East China School District. A graduate of Marine City High School herself, she is going into her tenth year of teaching business education. “I’m a local in the area,” she says. “It’s incredible to teach at the high school that I graduated from. I feel really blessed to be there with the students, work with them every day, and have an impact on their lives. They have quite an impact on me too!”

During the 2016-2017 school year, Laurie participated in professional development at St. Clair County RESA to redesign her classroom and turn it into a 21st Century Classroom.

As a student, Laurie never had a class on financial literacy. Like many of her generation, she was never taught about investing or saving. They didn’t cover budgeting, insurance or retirement in her high school curriculum; for educators, this was uncharted territory.

“I remember thinking when I first started teaching financial management: We have no textbook. How is this going to work?” she said. “I was used to teaching with a textbook.” Laurie attributes her curriculum largely to the free resources available to educators online. She also creates lesson plans using what she has learned from her colleague, Amanda Volz, who teaches personal finance at St. Clair High School, also in the East China School District.

In her approach to teaching, Laurie does not believe there is one formula to effective education. Being flexible and perceptive of student needs is crucial ? especially when it comes to something as dynamic as personal finance. “I’m changing my teaching methods each year. I think we have to embrace technology and educational trends in a way that students want to learn and need to learn,” she explained.

Laurie involved her students in her classroom redesign to create the ideal learning environment.

Laurie's curriculum covers everything from insurance, to taxes, to budgeting, to credit, to investing, career planning, and much more. She equips her students with money management skills to guide them through each stage of life: renting an apartment, purchasing a house, purchasing an automobile, and saving for retirement.

As her students are exploring options for life after high school, Laurie sets aside class time to help her students apply for scholarships. "A handful of my students have received scholarships this year because of what they do in my classroom," she says. She is passionate about setting her students up for success – even beyond college. In her career unit, she has students dress in business casual, and then brings in community members to conduct mock interviews with the students.

Business Essentials II students collaborate at a Roasted with Perks in Marine City, Michigan. Students spent one semester working with the owner to revamp the restaurant's marketing plan.

In addition to using online materials, Laurie is a firm believer in experiential learning. She designs business competitions and project-based assignments for her students, applying class material to real-world problem solving. Her students have worked with local businesses, doing everything from revamping their websites, redesigning menus, analyzing finances to determining advertising costs. Networking within the community has countless advantages for students: part-time jobs, references for college applications, and lifelong connections.

She stresses the importance of aligning learning with entrepreneurial experiences. "We're getting the kids out there, having their ideas come to fruition," she says. "They really take ownership over their learning. They can see their ideas come to life." In one business competition, one of Laurie's students invented an insulin pump protector targeted towards diabetic athletes, winning her first place and a $500 scholarship.

Bringing in speakers from the finance industry is also instrumental in her methods. "It really supplements what I'm teaching them," she says, as bankers with real-world experience and insight capture the attention of her students. Laurie also brings in speakers from various professional fields, teaching students about potential careers after they graduate.

Laurie’s Business Essentials I student took 1st place and won a $500 scholarship in the Green Light Business Model Competition in Port Huron, Michigan.

Laurie is always looking for new ways to expand her curriculum. She implemented a Disney Youth Education Series program at her high school and takes students to attend a leadership and teamwork seminar. "Some of these kids have never been on plane. Or they've never left Marine City or their parents," she says. "They get to experience one of the best, most successful companies ever. Which is also the most magical place on earth."

The Disney Youth Education Series programs held at Epcot give students the chance to explore the connection between leadership, teamwork, and what makes Disney a successful company. Students are guided through an intensive behind-the-scenes tour of Magic Kingdom, learning about everything from guest satisfaction, safety, show, courtesy, to overall efficiency, to good communication. The program has only grown in popularity. "Now I have 40 signed up for next March. That is something I'm really proud of," says Laurie.

After years of teaching, she can see the impact she has on her students. She often finds her students coming to her comfortable work space, spending their lunch hour talking to each other about what cell phone plans are best and which type of bank account to choose. A lot of them are starting to purchase cars and discussing insurance plans. "They go home and they have these great conversations over dinner about what they learned in class, which makes me very proud of the impact of this class, and making a difference in their lives," says Laurie.

Marine City High School Business Education students participate in the Disney Youth Education Series Leadership Seminar at Epcot in May of 2016.

While her personal finance and business classes are not graduation requirements, Laurie would like to advocate for that in the future. "That's our goal eventually. If you can dream it, you can do it, right?" Laurie says.

Practical Money Skills would like to commend Laurie Gardner on her ongoing efforts and commitment to financial literacy at Marine City High School.

Share